Property Intelligence Platform

Transforming property risk assessment for insurance underwriters through AI-powered insights and intuitive data visualization—reducing claim processing time by 40%.

Overview

Insurance underwriters were drowning in manual processes, spending hours analyzing property data from multiple disconnected sources. The challenge was to design an AI-powered platform that would transform complex property data into actionable insights, reducing claim processing time by 40%.

As a Lead UX/Product Designer, my role was to lead the creation of an intuitive data visualization platform that would make complex property risk data accessible and actionable for insurance underwriters.

My Contribution

- UX Design

- Product Strategy

- User Research

- Data Visualization

The Team

- 1x Product Manager

- 4x Engineers

- 1x Designer

- 2x Data Scientists

Research & Discovery

The project began with a deep dive into the current landscape of insurance underwriting processes and the challenges faced by underwriters when analyzing property data.

User Pain Points

- • 3-5 hours per property for manual data analysis

- • Inconsistent risk assessment methods across teams

- • Limited visibility into property condition changes

- • Reactive rather than proactive risk management

User Needs

- • Automated risk scoring with high accuracy

- • Real-time property monitoring and alerts

- • Intuitive data visualization

- • Streamlined workflows

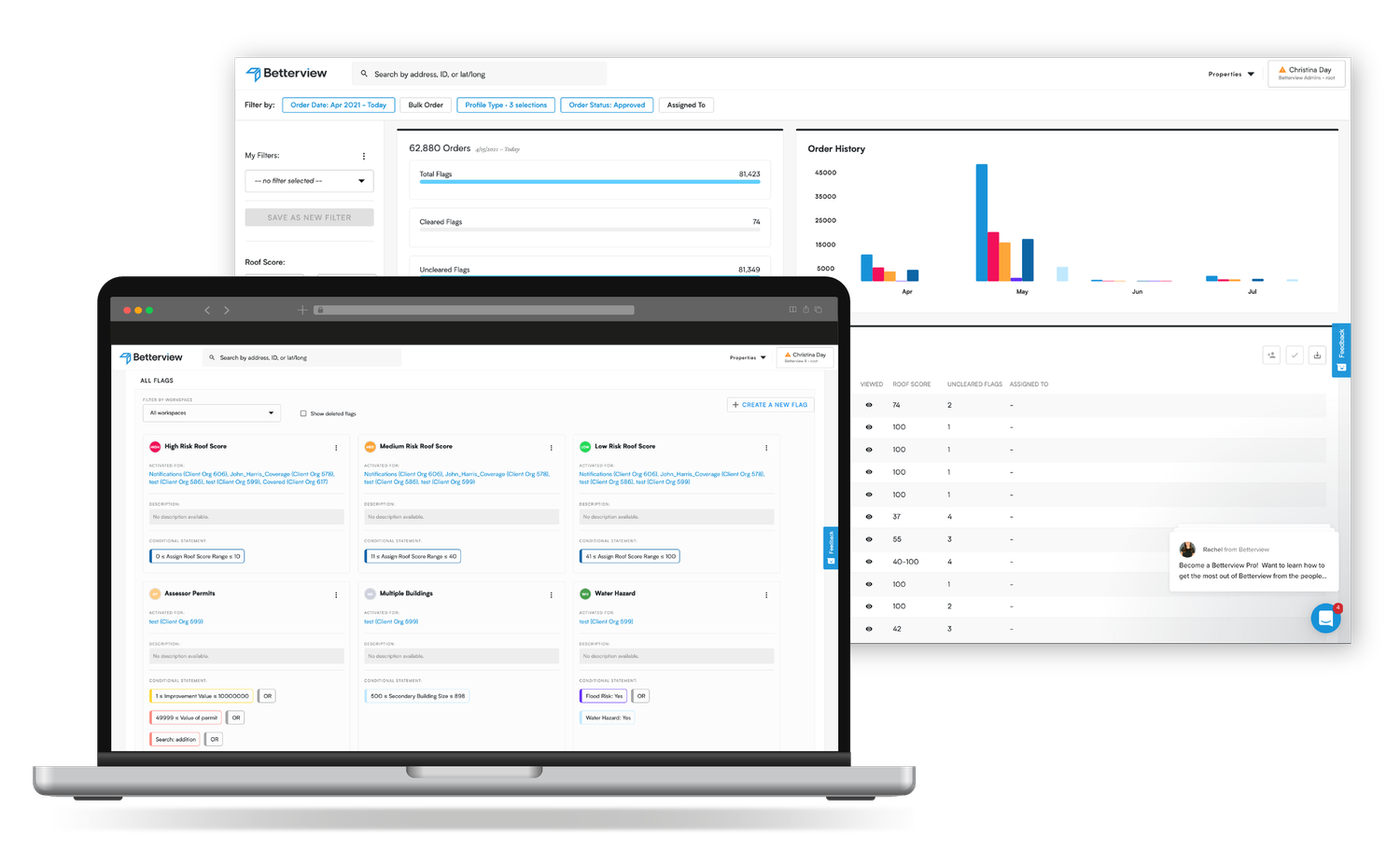

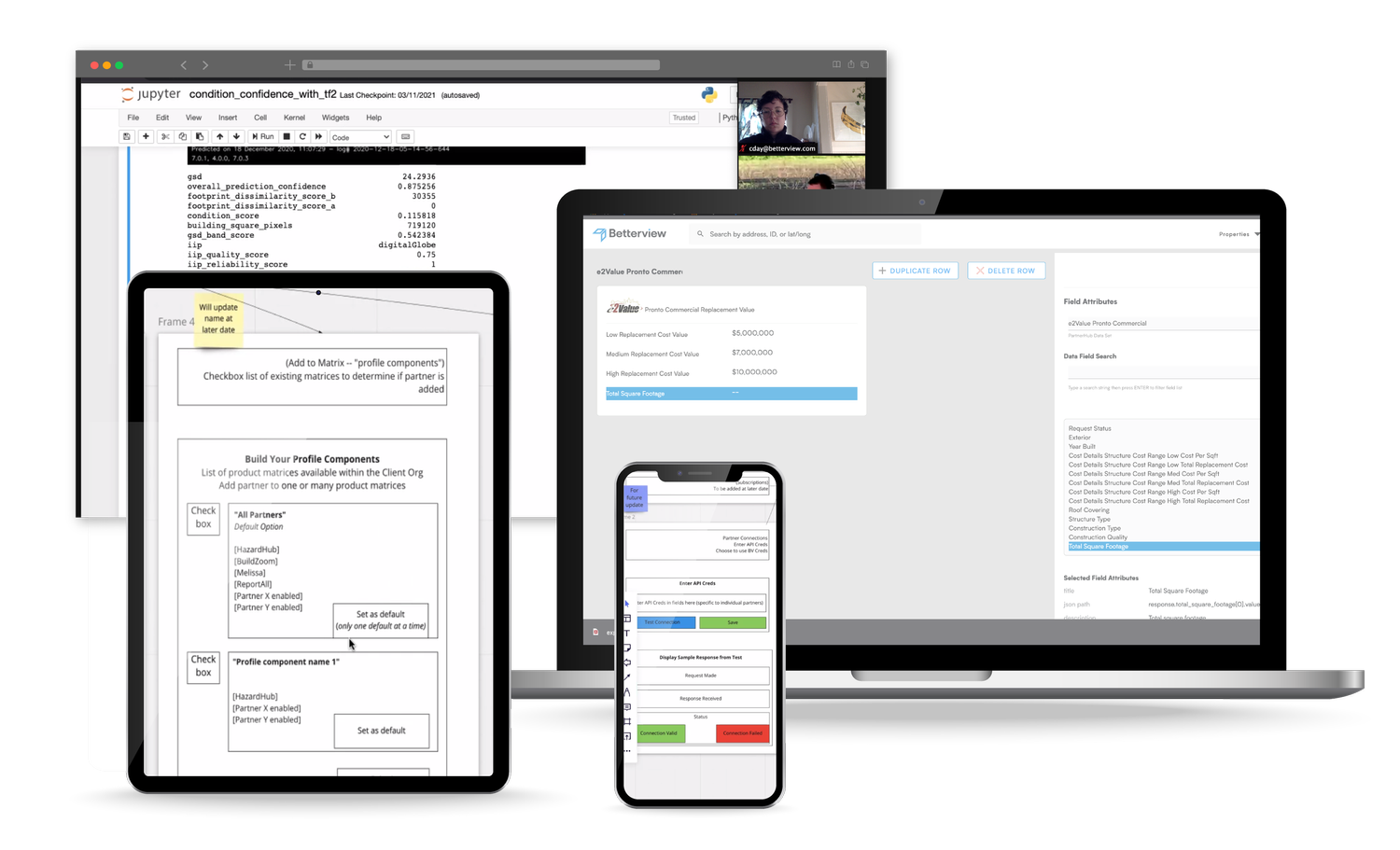

Property intelligence user research and wireframes

Design Development

The design process focused on creating an AI-powered platform that would transform complex property data into actionable insights. Through iterative design and user testing, we developed an intuitive interface that could handle real-time data processing while maintaining usability.

Key Features

- • AI Risk Scoring

- • Data Visualization

- • Real-time Monitoring

- • Customizable Alerts

Design Process

- • User Research

- • Wireframing

- • Interactive Prototyping

- • Usability Testing

Property intelligence data visualization and interface design

Platform Features

AI Risk Scoring

Machine learning algorithms analyze property data to generate accurate risk scores automatically.

Data Visualization

Interactive dashboards that make complex property data intuitive and actionable for underwriters.

Real-time Monitoring

Continuous property monitoring with instant alerts for condition changes and risk factors.

Results & Impact

The platform revolutionized how insurance underwriters assess property risk, delivering measurable improvements in efficiency, accuracy, and cost savings.

Operational Efficiency

Reduced claim processing time by 40% and improved data accuracy by 60% through automated AI-powered risk assessment

Business Impact

Generated $2M+ in annual cost savings while serving 500+ active users across multiple insurance companies